Bookkeeping

The difference between perpetual LIFO and periodic LIFO

He has a CPA license in the Philippines and a BS in Accountancy graduate at Silliman University. After the January 10 sale, we still have 150 units from the second layer and it is enough to cover the January 15 sale of 120 units. As of January 15, we still have 30 units from beginning inventory and 30 units from the January 5 purchase. Preparing a schedule of LIFO layers before updating perpetual records for a sale is important in making sure you take COGS from the most recent layer. Take note that you have to repeat this step before you make entries to LIFO layers.

How Is Inventory Tracked Under a Perpetual Inventory System?

In a perpetual system, you would not calculate the WAC using a formula for a specific period. You can use WAC to calculate an average unit cost, COGS for a period and ending inventory for a period. For example, Ava wants to figure out the average cost to assign for Acetone repackaged in her company’s warehouse.

Example – LIFO periodic system in a manufacturing company:

It is far more sophisticated than the periodic system of inventory management. A perpetual inventory system allows for quick identification and resolution of issues such as stock discrepancies or data entry errors. Since updates occur in real-time, businesses can promptly address any inconsistencies that may arise. In contrast, a periodic inventory system only identifies problems during physical inventory counts at specific intervals, making it difficult to pinpoint when an issue occurred and delaying its resolution.

Information Relating to All Cost Allocation Methods, but Specific to Perpetual Inventory Updating

These costs include the labour and materials costs but leave off any distribution or sales costs. Huge businesses have difficulty performing the cycle counts that are necessary for a periodic system. Further, an organisation with several retail locations may find it is easier to control inventory when there’s a regularly updated database of products. Take, for example, a tool retailer that has a customer looking for a specific type of wrench, one that is rarely requested and sold.

How to use our LIFO method calculator

The reason for the difference is that the periodic method does not take into account the precise timing of inventory movement which is accounted for in the perpetual calculation. Due to the simplification in the periodic calculation, slight variance between the two LIFO calculations can be expected. If the bookstore sells the textbook for $110, its gross profit under perpetual LIFO will be $21 ($110 – $89). Note that this $21 is different than the gross profit of $20 under periodic LIFO.

As you’ve learned, the perpetual inventory system is updated continuously to reflect the current status of inventory on an ongoing basis. Modern sales activity commonly uses electronic identifiers—such as bar codes and RFID technology—to account for inventory as it is purchased, monitored, and sold. Specific identification inventory methods also commonly use a manual form of the perpetual system. The Weighted Average Cost (WAC) is the cost flow assumption businesses use to value their inventory. Also called the moving average cost method, accountants perform this differently in a perpetual system as compared to a periodic system. The three cost flow assumptions that businesses use for this are FIFO, LIFO, and the Weighted Average Cost (WAC).

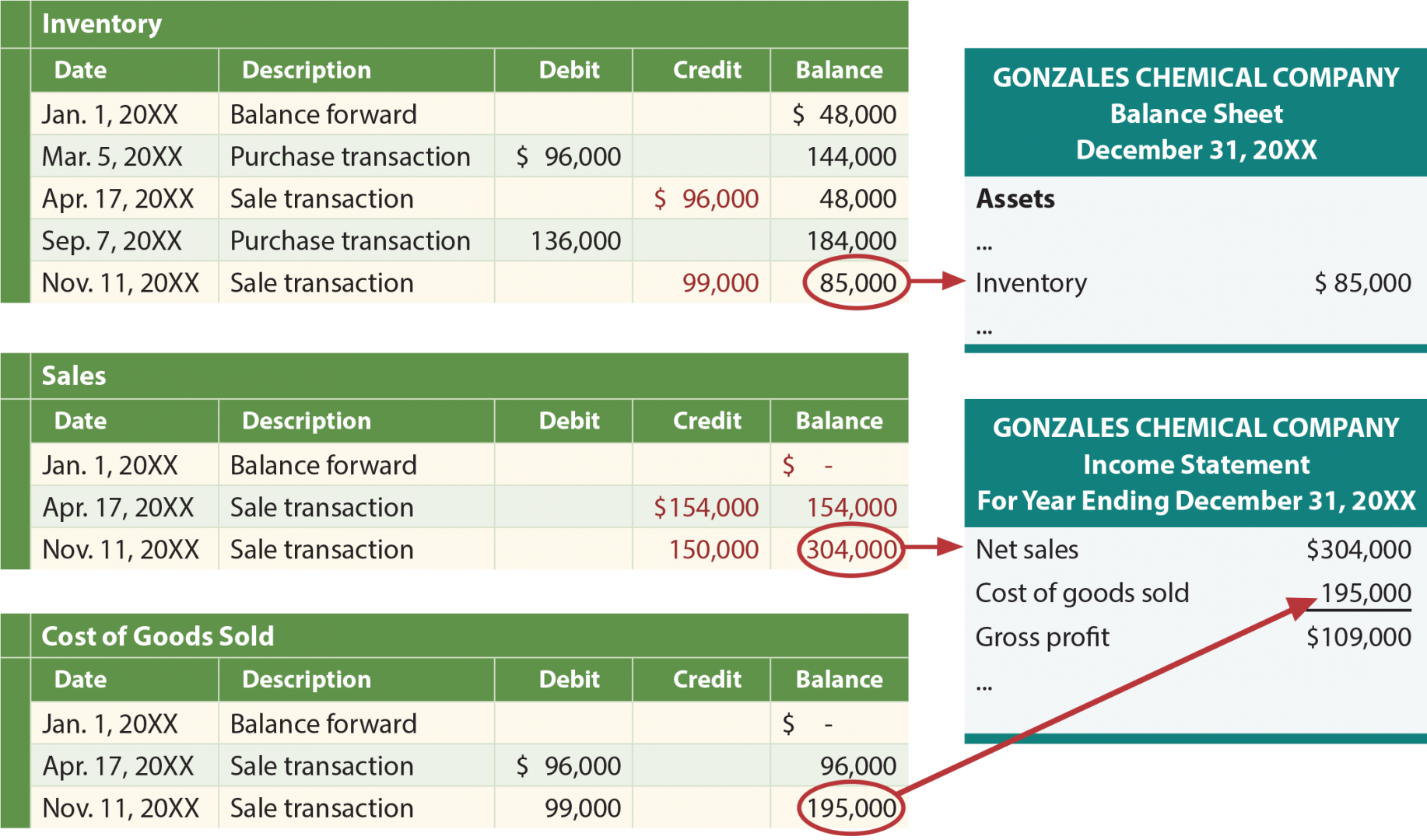

A perpetual inventory system continuously updates stock levels as transactions occur. This real-time tracking provides accurate information on current inventory levels and quantities at any given time. On the other hand, a periodic inventory system only updates stock levels at scheduled intervals, typically at month-end or year-end when physical counts are conducted. This can lead to discrepancies between actual and recorded inventories due to theft, damage, or errors. The cost of goods sold, inventory, and gross margin shown in Figure 10.19 were determined from the previously-stated data, particular to perpetual, AVG costing.

Journal entries are not shown, but the following discussion provides the information that would be used in recording the necessary journal entries. Each time a product is sold, a revenue entry would be made to record the sales revenue and the corresponding accounts receivable or cash from the sale. LIFO (last-in, first-out) is a cost flow assumption that businesses use to value their stock where the last items placed in inventory are the first items sold. So the remaining inventory at the end of the period is the oldest purchased or produced. In a perpetual LIFO system, the last costs available at the time of the sale are the first that software moves from the inventory account and debits from the COGS account. See the example LIFO perpetual inventory card below to get an idea of how it works.

The FIFO (First-In, First-Out) method in a perpetual inventory system has several advantages and disadvantages. Advantages include a more accurate reflection of inventory costs, as older, potentially lower-cost items are sold first, which can result in higher net income during periods best invoicing software for small businesses 2021 of rising prices. However, disadvantages include potentially higher tax liabilities due to higher reported income and less relevance in industries where the newest items are sold first. Additionally, during periods of inflation, FIFO can overstate profits and inventory values.

- Further, an organisation with several retail locations may find it is easier to control inventory when there’s a regularly updated database of products.

- However, the way of computation may differ if you’re using the periodic inventory vs perpetual inventory system.

- The perpetual inventory system keeps track of inventory balances continuously.

- Also, you will see a more significant remaining inventory value because the most expensive items were bought and kept at the very beginning.

- The 220 lamps Lee has not yet sold would still be considered inventory, and their value would be based on the prices not yet used in the calculation.

Ava’s business uses the calendar year (starting on Jan. 1 and ending Dec. 31) for recording inventory. The company accountant valued the Jan. 1 beginning inventory of generic Acetaminophen at $49,000, or 4,900 bottles. During the year, generic Acetaminophen costs the company $40,000 for materials and labour. On Dec. 31, the company accountants valued the ending inventory at $30,000. Other businesses that need perpetual inventory include those that specialise in drop shipping, where the manufacturers ship directly to customers or those who specialise in trade and distribution.