Bookkeeping

Closing Journal Entries

In accounting terms, these journal entries are termed as closing entries. The main purpose of these closing entries is to bring the temporary journal account balances to zero for the next accounting period, which keeps the accounts reconciled. Here you will focus on debiting all of your business’s revenue accounts. Other accounting software, such as Oracle’s PeopleSoft™, post closing entries to a special accounting period that keeps them separate from all of the other entries. So, even though the process today is slightly (or completely) different than it was in the days of manual paper systems, the basic process is still important to understand.

Step 3: Close and Credit

All the temporary accounts, including revenue, expense, and dividends, have now been reset to zero. The balances from these temporary accounts have been transferred to the permanent account, retained earnings. The purpose of closing entries is to prepare the temporary accounts for the next accounting period. A closing entry is a journal entry that is made at the end of an accounting period to transfer balances from a temporary account to a permanent account. At the end of an accounting period when the books of accounts are at finalization stage, some special journal entries are required to be passed.

The Income Summary Account

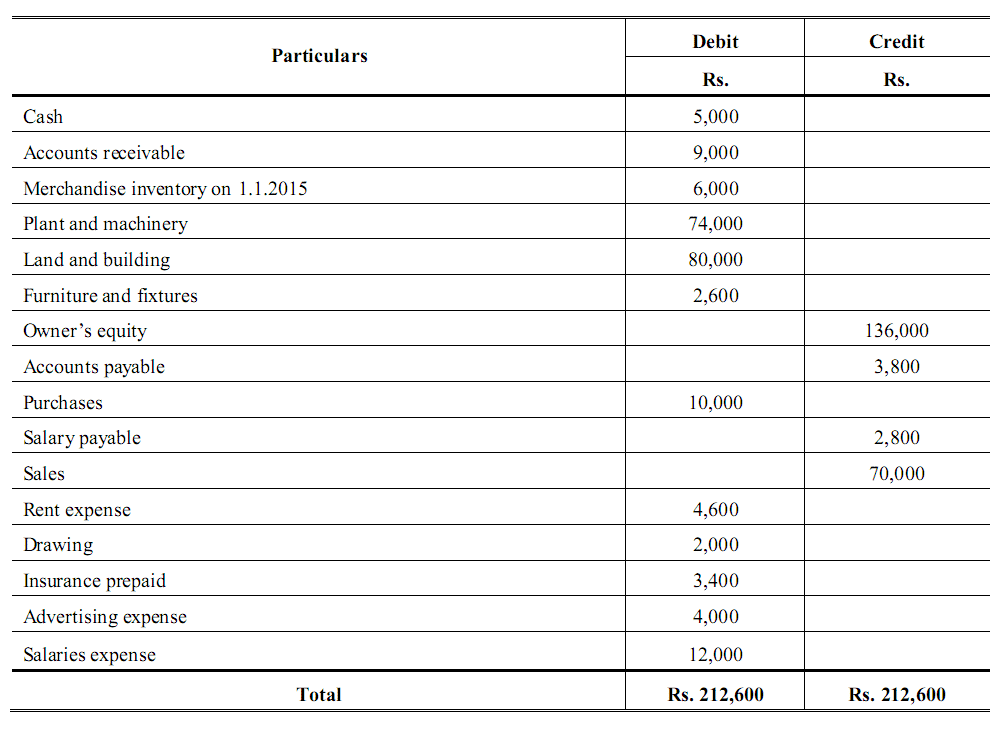

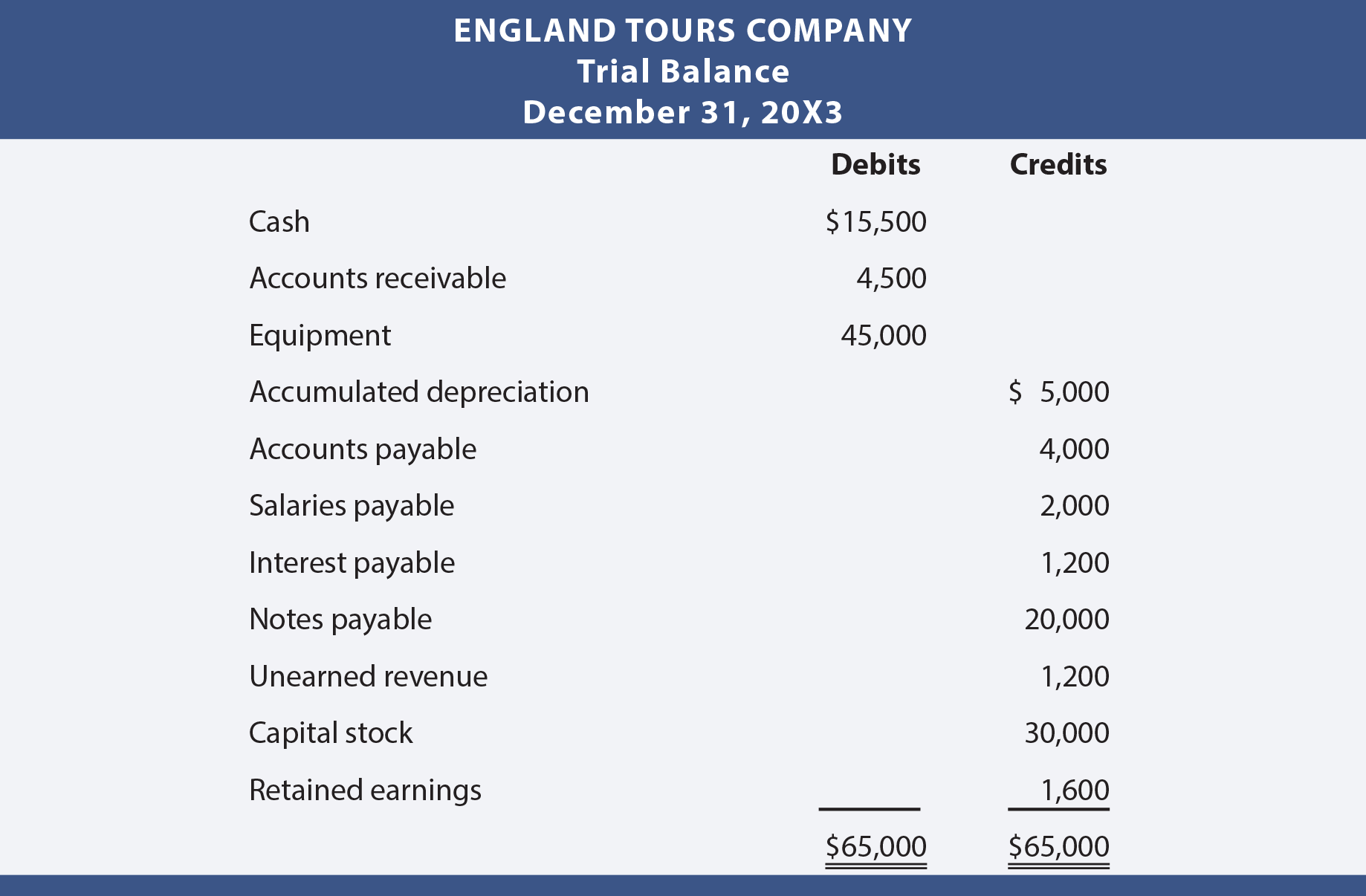

- In this case, we can see the snapshot of the opening trial balance below.

- It’s not necessarily a process meant for the faint of heart because it involves identifying and moving numerous data from temporary to permanent accounts on the income statement.

- The purpose of closing entries is to prepare the temporary accounts for the next accounting period.

- In this guide, we delve into what closing entries are, including examples, the process of journalizing and posting them, and their significance in financial management.

The last step of an accounting cycle is to prepare post-closing trial balance. As a result, the temporary accounts will begin the following accounting year with zero balances. In addition, if the accounting system uses subledgers, it must close out each subledger for the month prior to closing the general ledger for the entire company. If the subsidiaries also use their own subledgers, then their subledgers must be closed out before the results of the subsidiaries can be transferred to the books of the parent company. Since the income summary account is only a transitional account, it is also acceptable to close directly to the retained earnings account and bypass the income summary account entirely.

Closing Journal Entries Process

Now that we have closed income and expenses, we need to move the balances from the income summary to retained earnings. The next and final step in the accounting cycle is to prepare one last post-closing trial balance. Now, all the temporary accounts have their respective figures allocated, showcasing the revenue the bakery has generated, the expenses it has incurred, and the dividends declared throughout the past year. Once we have made the adjusting entries for the entire accounting year, we have obtained the adjusted trial balance, which reflects an accurate and fair view of the bakery’s financial position. Now, it’s time to close the income summary to the retained earnings (since we’re dealing with a company, not a small business or sole proprietorship).

Explore our full suite of Finance Automation capabilities

Instead, the basic closing step is to access an option in the software to close the reporting period. Doing so automatically populates the retained earnings account for you, and prevents any further transactions from being recorded in the system for the period that has been closed. Remember the income statement is like a moving picture of a business, reporting revenues and expenses for a period of time (usually a year).

Step 3: Close Income Summary to the appropriate capital account

Organizations can achieve a 40% increase in close productivity, resulting in a more streamlined financial close process and allowing your team to focus on more strategic activities. The trial balance is like a snapshot of your business’s financial health at a specific moment. It lists the current balances in all your general ledger accounts. In this case, we can see the snapshot of the opening trial balance below. Keep in mind, however, that this account is only purposeful for closing the books, and thus, it is not recorded into any accounting reports and has a zero balance at the end of the closing process. Thus, the income summary temporarily holds only revenue and expense balances.

All temporary accounts eventually get closed to retained earnings and are presented on the balance sheet. Closing all temporary accounts to the retained earnings account is faster than using the income summary account method because it saves a step. There is no need to close temporary accounts to another temporary account (income summary account) what is the difference between a ledger and a trial balance in order to then close that again. ‘Total expenses‘ account is credited to record the closing entry for expense accounts. Closing entries transfer the balances from the temporary accounts to a permanent or real account at the end of the accounting year. We see from the adjusted trial balance that our revenue account has a credit balance.

With the use of modern accounting software, this process often takes place automatically. That’s why most business owners avoid the struggle by investing in cloud accounting software instead. You might not feel like an expert in closing entries just yet but you can always refer back to refresh your memory.